Carl Gould

Posts by Carl Gould:

Will AI soon be making all hiring decisions?

We get a look from Business Advisor Carl Gould. Listen here:

Advisory Boards Are the Secret to Growing a Business

CLG Collective Podcast – The Value Builder System with John Warrilow

Episode 008 - John Warrilow

John Warrillow is the founder of The Value Builder System™, a simple software for building the value of a company used by thousands of businesses worldwide. John is the author of the bestselling book, Built to Sell: Creating a Business That Can Thrive Without You, which was recognized by both Fortune and Inc magazines as one of the best business books of 2011. Before founding The Value Builder System™, John started and exited four companies.

CLG Collective Podcast – Shark Attack with Paul de Gelder

Episode 004 - Paul de Gelder

In this episode of the Carl Gould Collective Podcast, Carl Gould interviews Paul de Gelder, a former paratrooper in the Royal Australian Army and Navy clearance diver. Paul shares his journey from being a peacekeeper in East Timor to become a member of the elite dive team. He also talks about the varied and exciting roles he played as a clearance diver, including underwater battle damage repair and land-based EOD.

Here are the top three takeaways from the podcast:

-

Embrace challenges: Paul talks about how he faced numerous challenges in his life, from being kicked out of his home at 17 to having his deployment to Iraq revoked. Despite these setbacks, he remained determined to find his dream job and poured his heart and soul into becoming a Navy clearance diver. His message to listeners is to embrace challenges and use them as an opportunity for growth.

-

Pursue your passion: Paul discovered his passion for diving and used it as a way to move up in his career. He says that finding your passion is crucial to achieving success in life. He advises listeners to try new things and explore different interests to find what truly excites them.

-

Be adaptable: As a clearance diver, Paul had to be adaptable and prepared for any situation. He talks about the varied roles he played as a diver, from doing underwater battle damage repair to land-based EOD. He advises listeners to be open-minded and adaptable, as it will help them navigate any situation they may face in their personal or professional life.

Overall, Paul’s story is one of perseverance, determination, and embracing new challenges. His message to listeners is to find their passion, embrace challenges, and be adaptable to achieve their goals.

CLG Collective Podcast – Father of Modern Networking, Dr Ivan Misner

Episode 013 - Dr. Ivan Misner

In this episode of the Carl Gould Collective podcast, Carl Gould interviews Dr. Ivan Misner, the founder of BNI, the largest business networking organization in the world. Misner discusses the thought process behind starting BNI and his vision for creating a networking group that was both relational and focused on business without being mercenary. He merged these two ideas to create the core value of “givers gain,” which emphasizes helping others as a means of receiving help in return.

Misner also talks about the challenges he faced when starting BNI and how he created systems and processes to scale the business. He read “The E-Myth” by Michael Gerber and followed his advice to work on the business, not in the business, and create an org chart as if he were going to franchise the business. Misner explains that BNI operates as a licensing model, where individuals can pay a fee to use the BNI name and system, and the organization also generates revenue through training, events, and other services.

Throughout the interview, Misner emphasizes the importance of accountability in networking and how BNI encourages members to be active participants and contribute to the group. He also shares tips for effective networking, such as building relationships with others, being specific about the referrals you’re seeking, and following up consistently.

Overall, the interview provides valuable insights into the founding and growth of BNI, as well as the principles of effective networking that can benefit any business leader or entrepreneur.

The top three takeaways from the interview are:

- Accountability is key to success in networking groups, and BNI has an attendance requirement and encourages members to bring referrals regularly.

- Dr. Misner’s plan to scale the business involved creating systems and processes, writing everything down, and creating an org chart as if he were going to franchise the business.

- The success of BNI is due to its focus on relationships and helping others, as well as its consistent adherence to its core values.

CLG Collective Podcast – Building Your Personal Brand with Rey Perez

Episode 001 - Rey Perez

Global Branding Expert, Rey Perez talks about personal branding and how it can help business owners and CEOs build relationships and attract more clients. Rey talks about the importance of personal branding for service and product-driven businesses and for those who are the face of their business. He emphasizes the need to leverage digital resources like the internet, social media, and websites to build relationships faster and create something that can be leveraged over and over again.

The difference between a personal brand and a business brand is explained, with personal branding being about the person behind the business and their unique qualities, skills, and experiences. Rey provides examples of how personal branding has helped people attract more clients, build trust, and establish themselves as thought leaders in their industry.

Top Takeaways:

- Building a personal brand is crucial for entrepreneurs and CEOs who are the face of their business, as it allows them to create a connection and relationship with potential customers before they make a buying decision.

- The internet, mobile devices, and social media provide entrepreneurs with a powerful digital resource to build relationships with customers faster and more efficiently and leverage their time and efforts.

- A personal brand is different from a business brand, and involves creating a clear and consistent image of yourself as a thought leader and expert in your industry while showcasing your unique personality and values. It can help entrepreneurs stand out in a crowded market, and establish credibility and trust with potential customers.

Working Remotely

Compass Media Network – This Morning America’s First News

WCBS TV Interview

Mayor Adams says city employees must return to work in-person, no hybrid schedules allowed!

President Biden meets with Fed Chair

WPHL PHILADELPHIA TV INTERVIEW / Live –

https://phl17.com/phl17-news/president-biden-meets-with-fed-chair/

The Arthur Aidala Show

What about Crypto currency?

https://omny.fm/shows/the-arthur-aidala-power-hour/the-arthur-aidala-power-hour-5-13-22

Why Business Blind Spots Can Cause Your Firm To Crash

Most drivers know how to identify blind spots on the road, but did you know that we also have blind spots in business, and if we ignore them, we can get sideswiped? Read full article by clicking on the link below.

The Power of Sales Scripts

A good script can address concerns and provide robust responses. Moreover, effective scripts train your team on how to close. Read the full article HERE

Becoming a serial entrepreneur with multimillion-dollar businesses with Carl Gould

guest on Entrepreneur Lifestyle podcast with Ben Ivey, listen HERE

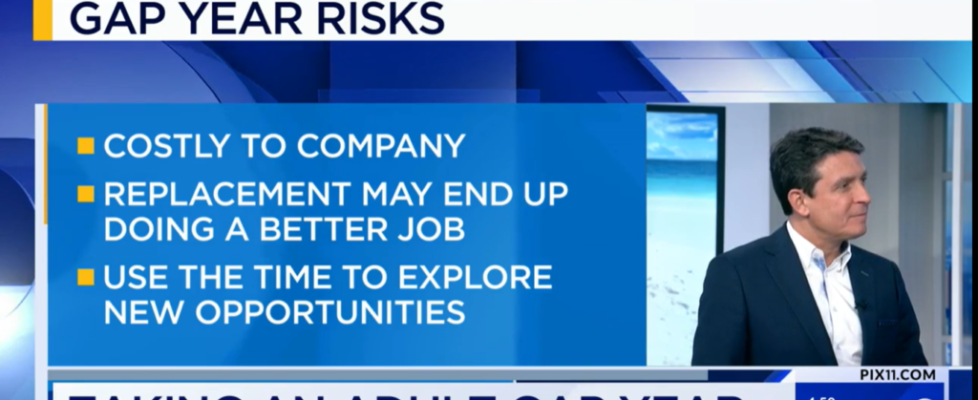

The Great Resignation

Carl Gould returns… With ‘The Great Resignation’ continuing and labor shortages in many industries this may be the year you ask for a raise. Employers in businesses big and small are desperate to attract, and more importantly, retain employees. Listen HERE

Burn out is an epidemic among American workers

Why is everyone burnt out? A therapist and consultant both join The Factor to discuss. Watch the full interview HERE

Expert shares advice for small businesses owners amid Omicron surge

Many small businesses have had a tough time since the pandemic began. Business growth strategist Carl Gould joined us on Good Day Rochester with some advice for small businesses owners on how to stay afloat as the omicron variant has the number of new COVID-19 cases at a new high. Watch the interview HERE