CoronaVirus – Impact on the Economy

Buckle Up! CoronaVirus, and the Impact on the Economy- by Carl Gould

If you thought the ride was over, buckle up as there appears to be more to come!

The Back Story

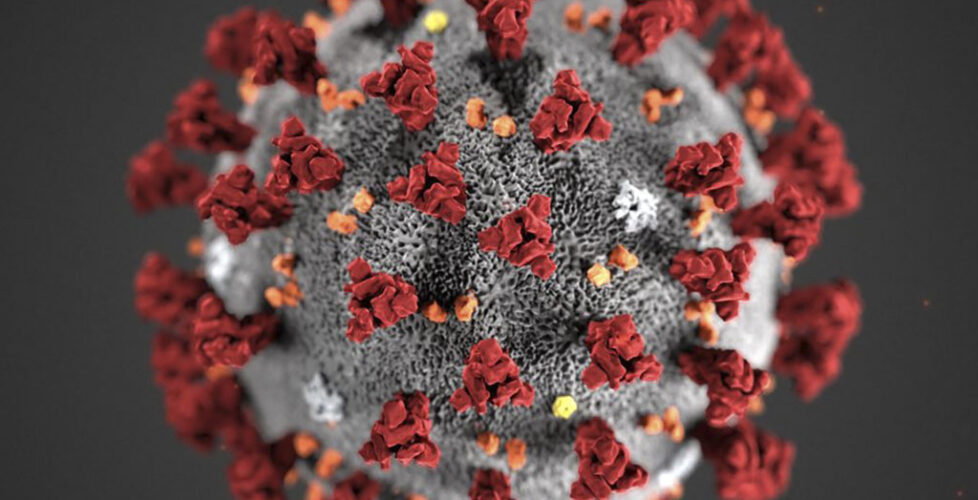

The back story…Coronaviruses (CoV) are a large family of viruses that cause illness ranging from the common cold to more severe diseases. COVID-19 is the infectious disease caused by the most recently discovered coronavirus.

Centers for Disease Control and Prevention (CDC) is currently responding to an outbreak of coronavirus 2019. The virus has been named “SARS-CoV-2” and the disease it causes has been named “coronavirus disease 2019” (abbreviated “COVID-19”).

What will this mean for the economy?

The Federal Reserve executed an emergency half-percentage-point rate cut and markets slid, reflecting fears the coronavirus epidemic is raising recession risks for the U.S. and global economies. -WSJ

The FED cutting their rate signifies that they are worried about a correction. The market will likely continue to correct for the next 6 months possibly through the elections.

When there is uncertainty in the market, consumers and companies hold off on major purchases and capital expenditures. This further exacerbates and lengthens the correction.

The correction will likely continue until we get to the bottom of the coronavirus problem. Then we will have to get to what is perceived as the bottom of the market correction before things will turn back up. I would expect this to be at least until the fall and likely into the elections

The economy, and more specifically the Dow Jones industrial average, is President Trump’s firewall for re-election. He needs the economy to be strong and possibly even trending upward in order to be re-elected. So, he will try every stimulus he can between now and the elections to bolster the economy.

If your business, or your client’s businesses’ supply chain runs through China, there are a few measures you can take:

- Overstock NOW! Chinese companies are desperate to prove that things have returned to normal. Take advantage of this window of time and add stock. You count on there being shortages and delays over the next 6months. Get ahead of it NOW.

- Maximize your buying power– The FED just cut it’s rate, making it easier and cheaper than ever to borrow. Refinance your mortgages, increase your lines of credit, and put yourself in the best position to take advantage of an opportunity should it present itself.

- Hoard your cash– There is a storm coming and you need to weather it. Sock away all the cash you can and have at least 6 months’ operating expenses in reserve. Your business may need it.

Read more articles by Carl Gould